Manufacturers with Supplier Payment Issues: Delayed Payments Suppliers Face

In the complex world of manufacturing, supplier payment issues can significantly disrupt operations, resulting in strained relationships and production delays. Understanding the […]

Working Capital Business Loan: Key Uses and Types for Small Business Growth

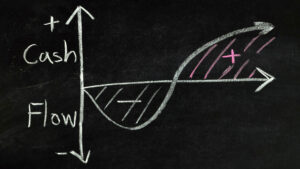

Navigating the intricate landscape of small business financing can often be daunting. However, understanding the potential of a Working Capital Business […]

Small Business Loans for Working Capital: Best Working Capital Loans for Growth

Finding the right working capital loan can be a significant turning point for small businesses seeking to maintain a stable cash flow, […]

Loans for Working Capital: Best Working Capital Loans & Loan Options with Working Capital

In the fast-paced world of business, maintaining a healthy cash flow is crucial for success. For entrepreneurs seeking to balance operational expenses […]

Addressing Payment Delays: How Healthcare Practices Struggle with Late Payments and Improve Cash Flow

In the dynamic realm of healthcare, managing an efficient cash flow is crucial to ensure the sustainability and growth of medical practices. […]

Short-Term Funding for Seasonal Businesses: Manage Seasonal Cash Flow

Managing cash flow is a critical challenge for seasonal businesses, where revenue fluctuations can create significant financial strain. Short-term funding for seasonal […]

Hospitality Cash Flow Management Strategies: Effective Cash Management for Business Success

In the dynamic world of hospitality, maintaining a healthy cash flow is crucial to business success. Effective hospitality cash flow management strategies […]

How to Obtain A Month-To-Date Report

When applying for business financing, business bank statements are always required. Underwriting may request a “month-to-date” report for several reasons. This resource […]

SBA Loan for Semi Truck

SBA Loan for Semi Truck: Guide to Commercial Vehicle Financing Navigating the complexities of financing a semi truck can be daunting, yet […]

Equipment Financing 101

Equipment financing is a broad term that refers to various financing options available for acquiring business equipment. The specific type of financing […]

SBA Express Loan for Veterans

SBA Express Loan for Veterans: Discover SBA Express Loans and More The SBA Express Loan program offers veterans a streamlined path to […]

Small Business Loan for Real Estate Investment

Optimizing SBA Loans: Small Business Loan for Real Estate Investment Securing the right funding is crucial for small businesses eyeing real estate […]